Lorraine During, Lead for Market Research, Digital Catapult

Many of us are aware of major corporations that have unlocked invaluable revenue streams by providing services related to products – rather than relying on one-off product sales. Think of organisations like Netflix or Spotify, which allow us to consume music or films as a service – rather than making purchases of physical CDs, DVDs, etc.

What is servitisation?

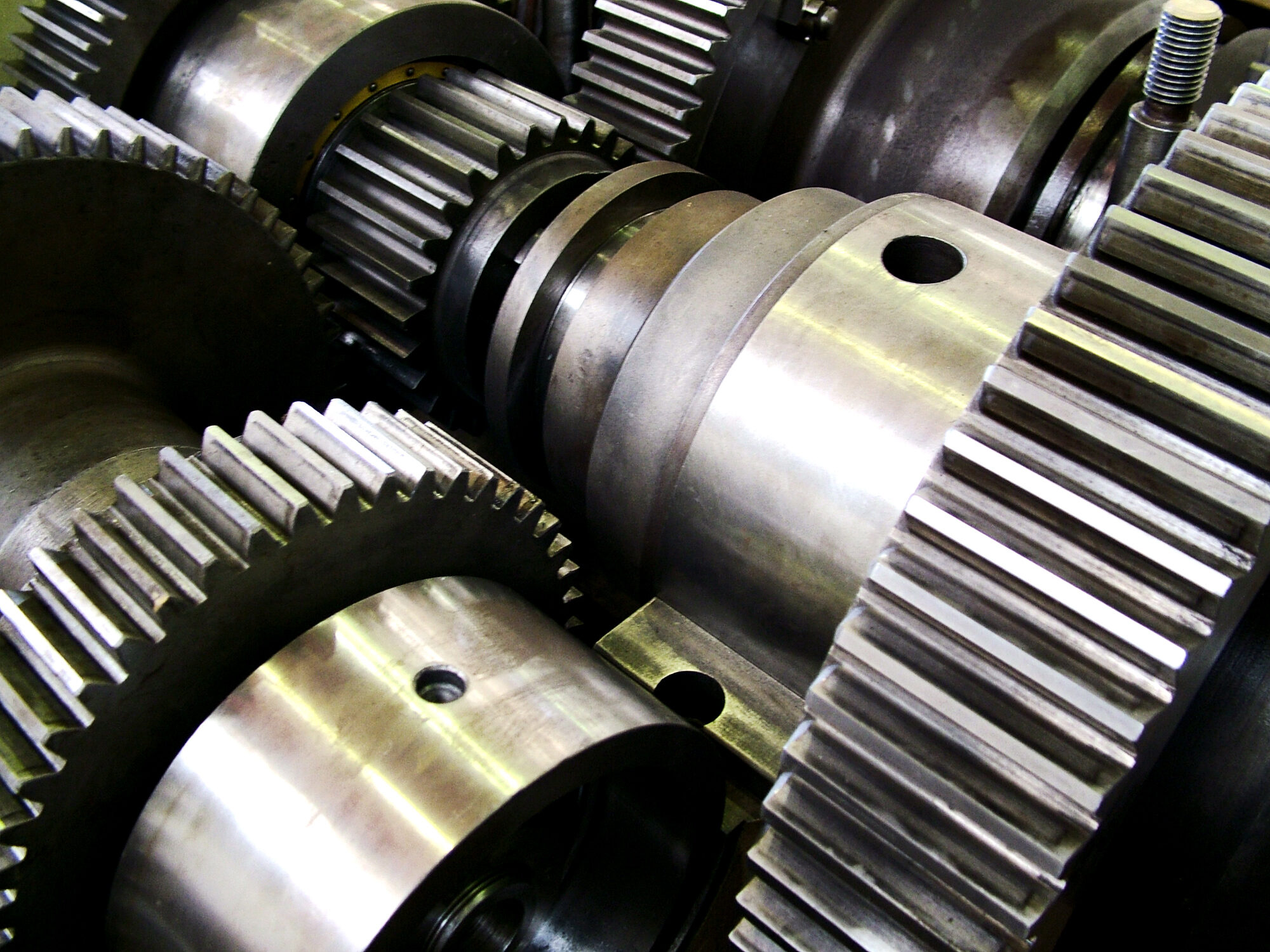

Away from the media and creative industries, servitisation has huge profit potential for sectors like manufacturing. It can involve a transformation of the manufacturer from a business which is focused on building revenues around the production and sale of products, to one where a significant, sustainable revenue stream comes from services that focus on the outcome from the use of its products.

Let’s take a real-life example: an organisation called AE Aerospace in Birmingham – which specialises in the manufacture of precision machine components – has been assessing how a ‘manufacturing-by-the-hour’ service could help to differentiate from competitors.

Since AE’s core activity revolves around traditional machining, they have integrated services on machine metal components into their offering. As a result of this new service, turnover has moved from £2.8m to £5m since 2016.

What does servitisation mean for the UK economy?

In the face of changes in consumer behaviour and an increasingly volatile socio-economic climate, the UK manufacturing industry has witnessed a rise in servitisation-based business models, with a 2020 report from the Manufacturer stating that 78% of manufacturers were either developing, or are already offering, services as an alternate revenue stream.

That said, uptake in the UK is not as widespread as it could be, meaning viable opportunities to accelerate economic growth are not being grasped. In particular, servitisation could be key to unlocking regional growth, such as in the South West of England and Wales – an area rich in manufacturing sub sectors including aerospace and defence.

What are the opportunities and blockers?

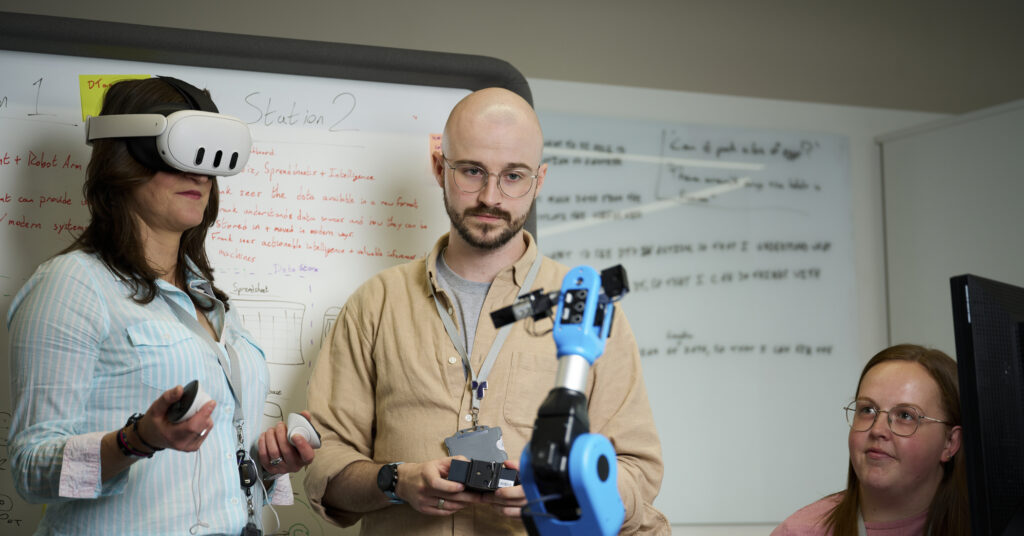

As part of DETI, an R&D initiative in the West of England to supercharge digital skills, Digital Catapult produced a report exploring the business case for servitisation to UK industry, as well as the current challenges preventing manufacturers from reaping the benefits.

Here are five key takeaways from the report:

- Servitisation could play a significant role in propelling regional growth.

The manufacturing industries have a significant presence in the South West of England, producing £14.8bn in output per year. An area steeped in industrial heritage, the region is home to the largest aerospace cluster in the UK, and is experiencing a growing appetite for digital skills.

Servitisation promises to play an important role in the post-COVID-19 regional economy, and has already shown potential for industries including aerospace, rail, heavy equipment and car rental. It has already delivered successes in the West Midlands, another region with a proud industrial history – with the Advanced Services Group (ASG) helping 157 manufacturing SMEs generate £32.25m in Gross Value Added through servitisation in the region.

The South West of England could stand to similarly benefit, given its specialism in transport and aerospace.

2. Servitisation could help manufacturers build stronger long-term relationships with customers.

By transforming the dynamics of manufacturer-customer relations from a one-time, completed transaction, to a series of regular interactions, manufacturers are given the opportunity to build a long-term relationship with customers.

Servitisation can lead to regular, service-related communications, allowing manufacturers to update customers on a variety of relevant information – including aspects such as equipment condition, and data related to predictive maintenance.

As an example, Digital Catapult recently worked with Baxi heating – a manufacturer and distributor of heating services and systems to explore innovations such as ‘heating-as-a-service’ maintenance plans, through remote monitoring using Internet of Things (IoT) sensors.