By Dr David Pugh, Director of Sustainable Industry at Digital Catapult

The net zero transition presents a significant opportunity for businesses around the world to develop and adopt new solutions that can cut their carbon emissions and improve their operational efficiency, and enhance their commercial performance. As it stands the global cleantech market was valued at $5.5 trillion last year, and is expected to reach $7.4 trillion by 2030, demonstrating the opportunities that exist for cleantech startups and how important climate-focused investments have become in the global economy.

To capitalise on the growing global demand for cleantech solutions, the UK must consider how it can increase investment into its own cleantech companies, and breaking down the barriers to investment is a good place to start. Many cleantech companies struggle to secure the funding needed to scale in the UK, largely due to limited investment support. As a result, they often fail to reach the stage where their solutions can be effectively adopted by large enterprises. This creates significant challenges for businesses, customers, and commercial partners seeking to reduce carbon emissions and align with the UK Government’s ambition to position the country as a “clean energy superpower.”

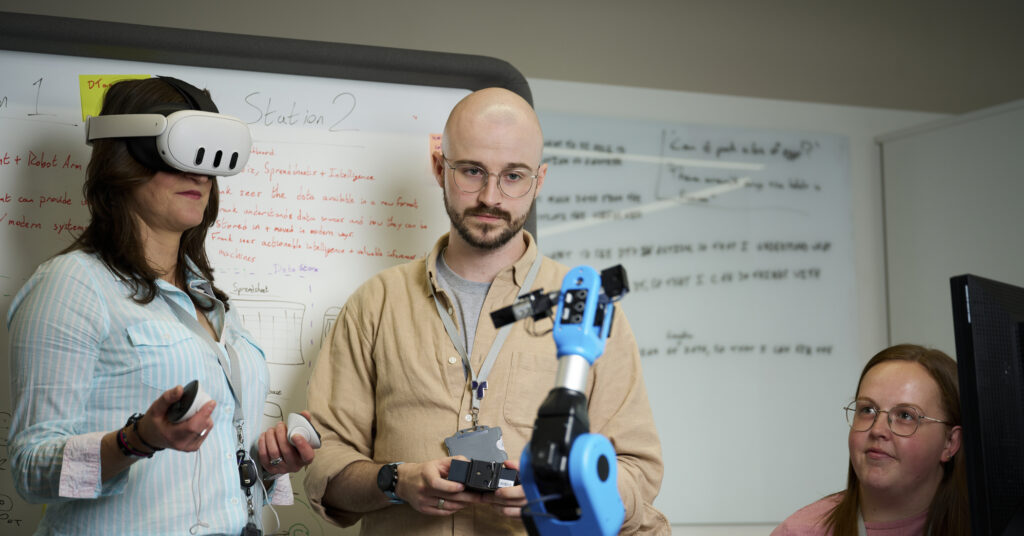

Digital Catapult is committed to advancing industrial sustainability in the UK through the practical application of deep tech solutions. This is why a new Investment Readiness Programme has been launched to help eight pioneering cleantech companies to raise the funding they need to scale their solutions, and enact lasting change in the country’s manufacturing industry. Initiatives like this will be critical to demonstrating how sustainable industrial growth can be achieved through deep-tech innovation, yielding significant long-term gains for the country’s economy, and empowering cleantech innovators to succeed.